Suffolk Businesses Underpaid Staff: Your Rights, Checks, and What to Do in the UK

Suffolk businesses underpaid staff has become a growing concern across the UK, especially as government enforcement around minimum wage rules becomes stricter. At BusinessWestern.co.uk, we focus on explaining complex UK business and employment issues in clear, practical language so workers and employers both understand their responsibilities and rights.

This guide explains why Suffolk businesses underpaid staff, how underpayment happens, how to check your pay, and what steps you can take if you are affected, using verified UK guidance and recent enforcement trends.

What Does “Suffolk Businesses Underpaid Staff” Mean?

Suffolk businesses underpaid staff refers to situations where employers in Suffolk pay workers less than the legal National Minimum Wage (NMW) or National Living Wage (NLW). This can happen intentionally or accidentally, but under UK law, the responsibility always sits with the employer.

Underpayment is not limited to hourly rates. Even if your stated wage looks correct, deductions or unpaid working time can still mean Suffolk businesses underpaid staff in real terms.

Why Suffolk Businesses Underpaid Staff Is a National Issue

While Suffolk-specific cases do not always appear in national headlines, the UK government regularly publishes “name and shame” lists of employers who fail to meet minimum wage laws. These lists include businesses of all sizes, from small local firms to major national brands.

In recent enforcement rounds, over 200 companies across the UK were found to have breached minimum wage laws, leading to millions of pounds in repayments and fines. This shows that Suffolk businesses underpaid staff is part of a wider national pattern, not an isolated local issue.

Common Reasons Suffolk Businesses Underpaid Staff

According to GOV.UK and Acas guidance, there are several recurring reasons Suffolk businesses underpaid staff, often without employers realising the full legal impact.

Unpaid Working Time

Employers must pay for all working time, including:

-

Mandatory training

-

Opening and closing duties

-

Time spent travelling between work locations

-

Waiting time when workers are required to stay on site

Failure to count these hours is one of the most common ways Suffolk businesses underpaid staff.

Uniform and Equipment Deductions

If an employer requires a uniform, tools, or safety equipment and deducts the cost from wages, this can push pay below the legal minimum. Even small deductions can mean Suffolk businesses underpaid staff when averaged hourly.

Incorrect Apprenticeship Rates

Paying the apprenticeship rate to workers who are not eligible is another frequent mistake. This often results in Suffolk businesses underpaid staff, especially among younger workers.

Salary Pay Miscalculations

Being on a salary does not remove minimum wage protection. When total hours worked are divided into pay received, many salaried employees discover Suffolk businesses underpaid staff unintentionally.

How to Check If You Are Being Underpaid in Suffolk

If you suspect Suffolk businesses underpaid staff, the first step is to check your pay carefully.

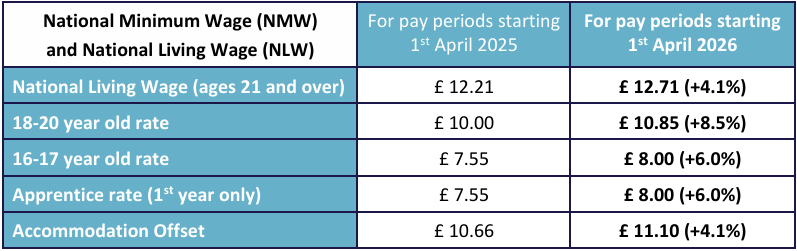

Step 1: Verify Your Wage Rate

Compare your hourly pay to the current National Minimum Wage or National Living Wage for your age group. Make sure deductions for uniforms, travel, or equipment are included in your calculations.

Step 2: Review Your Payslips

Check payslips for unexplained deductions or missing hours. Many cases where Suffolk businesses underpaid staff are uncovered through payslip reviews.

Step 3: Calculate Actual Hours Worked

List all hours worked, including training and required overtime. Divide your total pay by total hours to see your true hourly rate.

What To Do If Suffolk Businesses Underpaid Staff

UK law provides clear steps workers can take when Suffolk businesses underpaid staff.

Talk to Your Employer First

Many underpayment issues are resolved quickly once raised. Employers are encouraged by Acas to fix mistakes promptly and repay owed wages.

Contact Acas for Advice

Acas offers free, confidential guidance through its helpline on 0300 123 1100. They explain your rights if Suffolk businesses underpaid staff and guide you on next steps.

Raise a Formal Grievance

If informal discussions fail, follow your employer’s grievance procedure in writing. This creates a clear record if Suffolk businesses underpaid staff.

Report to HMRC

HM Revenue & Customs investigates minimum wage breaches. You can report underpayment confidentially if you believe Suffolk businesses underpaid staff.

Employment Tribunal Option

If other routes fail, you may take legal action through an employment tribunal. Be aware of strict time limits, usually three months minus one day from the underpayment issue.

Government Enforcement and “Name and Shame” Lists

The UK government regularly publishes enforcement results identifying employers who failed to pay minimum wage. These reports confirm that Suffolk businesses underpaid staff are treated as seriously as breaches anywhere else in the country.

Penalties often include:

-

Repayment of unpaid wages

-

Financial fines

-

Public naming of the business

-

Legal compliance monitoring

This public accountability is designed to discourage future cases where Suffolk businesses underpaid staff.

Real-World Examples From Suffolk

Local reporting has highlighted cases involving convenience stores, garages, salons, and distribution firms where Suffolk businesses underpaid staff by small amounts per worker that added up to thousands of pounds collectively.

These examples show that underpayment does not require deliberate wrongdoing. Even minor payroll errors can mean Suffolk businesses underpaid staff under UK law.

Impact on Workers and Employers

When Suffolk businesses underpaid staff, workers face financial stress and loss of trust, while employers risk fines, reputational damage, and legal costs.

For workers, knowing your rights is essential. For employers, regular payroll audits and clear wage policies help avoid situations where Suffolk businesses underpaid staff unintentionally.

How Employers Can Avoid Underpaying Staff in Suffolk

To prevent situations where Suffolk businesses underpaid staff, employers should:

-

Audit pay regularly against current wage rates

-

Pay for all working time

-

Review deductions carefully

-

Train managers on wage compliance

-

Use reliable payroll systems

Proactive compliance protects both staff and business reputation.

FAQs About Suffolk Businesses Underpaid Staff

What are my rights if Suffolk businesses underpaid staff?

You have the right to receive back pay for all underpaid wages and protection from unfair treatment for raising the issue.

How do I report a business in Suffolk for underpaying staff?

You can report suspected underpayment confidentially to HMRC, even if you no longer work there.

Can salaried workers be underpaid?

Yes. If total hours worked reduce your average hourly rate below the legal minimum, Suffolk businesses underpaid staff even on salary contracts.

Does underpayment have to be intentional?

No. Even accidental mistakes mean Suffolk businesses underpaid staff under the law.

How far back can unpaid wages be claimed?

HMRC can usually recover unpaid wages going back several years, depending on the case.

Why BusinessWestern.co.uk Covers Issues Like This

At BusinessWestern.co.uk, we aim to explain UK business, employment, and compliance topics in a clear and trustworthy way. Understanding issues like Suffolk businesses underpaid staff helps workers protect their rights and helps employers avoid costly mistakes.

As enforcement increases and transparency grows, staying informed is the best defence. Whether you are an employee checking your pay or a business owner reviewing compliance, clear knowledge reduces the risk that Suffolk businesses underpaid staff and builds a fairer local economy across the UK.