Neural Finance: Transforming Financial Decision-Making with AI

In today’s fast-evolving financial landscape, neural finance is revolutionizing how businesses and investors make decisions. At BusinessWestern.co.uk, we understand the importance of leveraging advanced AI technologies to stay ahead, and neural finance offers predictive insights that surpass traditional financial models.

What is Neural Finance?

Neural finance refers to the application of artificial intelligence, particularly neural networks, to analyze financial data for better decision-making. These systems mimic the human brain to identify complex patterns in vast datasets, powering tools for:

-

Credit scoring

-

Fraud detection

-

Algorithmic trading

-

Portfolio optimization

Unlike traditional financial models, neural finance delivers greater predictive accuracy by continuously learning from historical data.

Key Applications of Neural Finance

Neural finance is being applied across multiple financial domains:

-

Market Forecasting

Deep learning models like LSTMs and Transformers predict stock prices, volatility, and market trends. -

Risk Management

Detect anomalies, assess credit risks, and manage portfolios using autoencoders and pattern recognition. -

Algorithmic Trading

Intelligent agents execute trades automatically based on complex market signals. -

Credit Scoring

Identify ideal customers and predict loan defaults more accurately than traditional methods. -

Data Analysis

Process unstructured financial documents such as reports and news using OCR and neural search for actionable insights.

By integrating these tools, neural finance empowers businesses to make faster, more informed financial decisions.

How Neural Finance Works

The power of neural finance comes from its advanced pattern recognition and learning capabilities:

-

Pattern Recognition: Interconnected neural layers identify subtle relationships in financial time-series data.

-

Learning & Adaptation: Models adjust internal weights through backpropagation to improve predictions over time.

-

Advanced Architectures: Uses specialized models like Recurrent Neural Networks (RNNs), Long Short-Term Memory (LSTMs), and Transformers for complex data relationships.

This advanced AI architecture allows neural finance systems to continuously evolve, offering enhanced accuracy over conventional methods.

Benefits of Neural Finance

Businesses adopting neural finance enjoy multiple benefits:

-

Enhanced Accuracy: Outperforms classical econometric models in forecasting and classification.

-

Automation: Streamlines complex tasks from data ingestion to decision-making.

-

Contextual Understanding: Neural search adds financial context to queries, improving relevance and insight extraction.

At BusinessWestern.co.uk, we see how these innovations are transforming traditional finance into intelligent, data-driven operations.

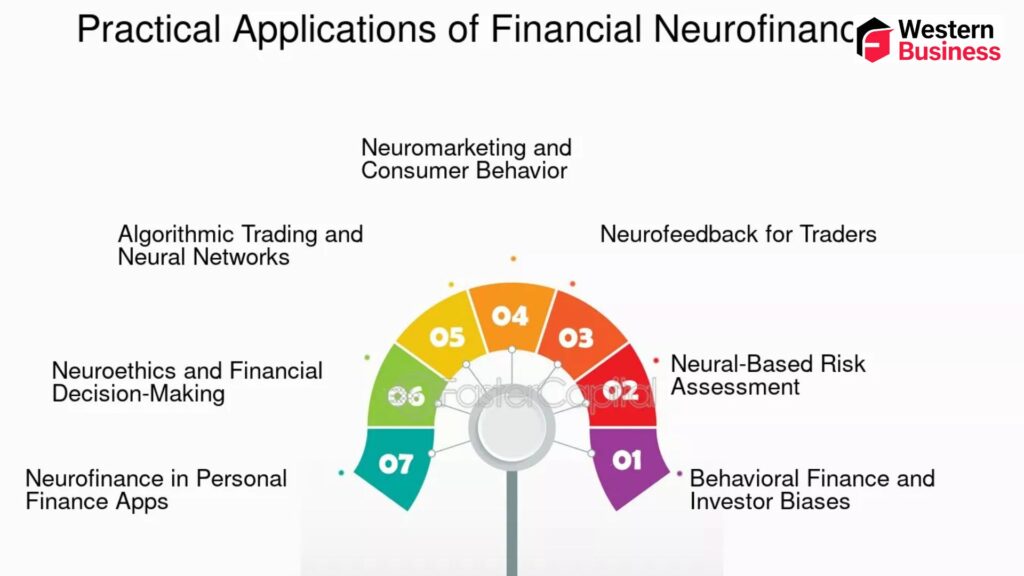

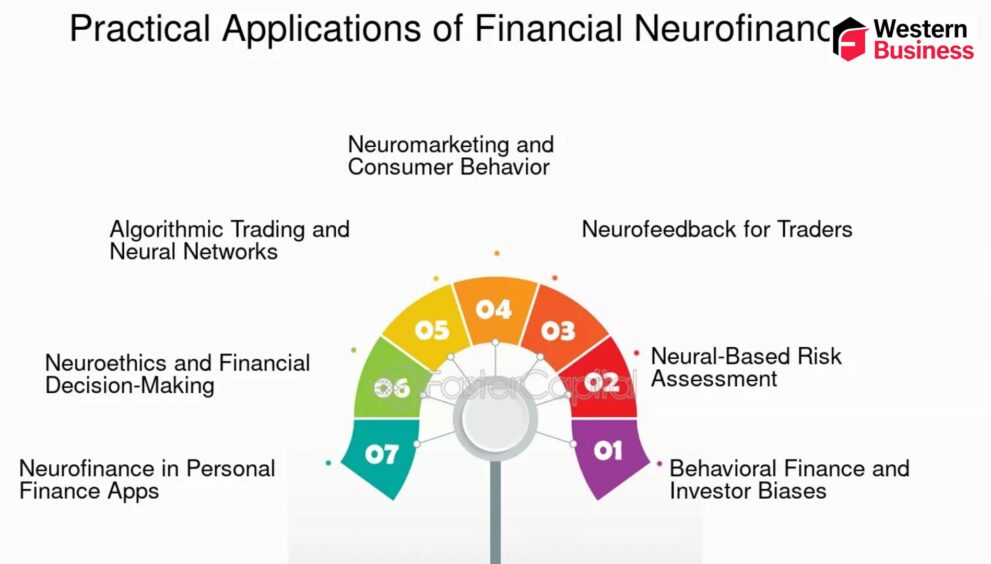

Neural Finance and Related Fields

Neurofinance, a related discipline, merges economics, psychology, and neuroscience to understand human financial decision-making. By incorporating insights from neural finance, businesses gain predictive power while also understanding behavioral factors influencing markets.

Real-World Examples of Neural Finance

-

Credit Risk Prediction: Banks use neural finance algorithms to identify borrowers likely to default, reducing losses.

-

Algorithmic Trading: Hedge funds implement LSTM models to anticipate market trends and optimize trades.

-

Financial Document Analysis: Investment firms analyze unstructured data, such as annual reports, using neural networks for faster, precise decision-making.

These examples illustrate how neural finance is no longer a theoretical concept but a practical tool reshaping financial strategy.

FAQs About Neural Finance

Q: What is a neural network in finance?

A: It’s an AI system with interconnected layers that identifies patterns in financial data for predictions, risk management, and automation.

Q: How does neural finance improve forecasting?

A: By analyzing historical and unstructured data, neural finance provides highly accurate market predictions compared to traditional models.

Q: Is neural finance suitable for small businesses?

A: Yes. Small businesses can leverage neural finance tools for automated decision-making, risk analysis, and smarter investment strategies.

Q: What is the difference between neural finance and traditional finance?

A: Traditional finance relies on static models, while neural finance uses AI to continuously learn from data, offering dynamic predictions.

Why Neural Finance Matters for UK Businesses

UK companies looking to remain competitive can benefit immensely from neural finance. From BusinessWestern.co.uk’s perspective, integrating AI-powered finance solutions helps businesses:

-

Reduce risk and optimize investments

-

Automate financial processes

-

Gain actionable insights from large datasets

By adopting neural finance, UK businesses can make data-driven decisions with higher accuracy and efficiency.

Conclusion

In conclusion, neural finance is transforming the financial industry by combining AI, machine learning, and neural networks to make smarter, faster, and more accurate financial decisions. At BusinessWestern.co.uk, we believe embracing neural finance is essential for businesses and investors aiming to stay competitive in today’s data-driven economy. Whether for risk management, algorithmic trading, or financial analysis, neural finance provides a cutting-edge advantage that can no longer be ignored.