HMRC AI R&D Claims Challenges: A Complete UK Business Guide

HMRC AI R&D claims challenges are reshaping how UK businesses prepare, submit, and defend Research & Development tax relief claims. With increased AI scrutiny, tribunal rulings, and longer enquiry times, companies must now adopt a far more robust and transparent approach.

At Business Western, we analyse complex UK business and tax developments to help companies stay compliant, informed, and resilient in an evolving regulatory environment.

What Are HMRC AI R&D Claims Challenges?

HMRC AI R&D claims challenges refer to the growing scrutiny applied by HMRC when artificial intelligence is involved in either R&D project development or the preparation and assessment of R&D tax relief claims.

HMRC has significantly increased its review activity, with approximately 17% of R&D claims now entering enquiry, creating average cash-flow delays of 246 days for affected businesses. This shift marks a new compliance reality for UK innovators.

Why HMRC Is Increasing Scrutiny on AI-Related R&D Claims

The rise of AI-driven innovation has complicated how R&D tax relief is assessed. HMRC AI R&D claims challenges stem from concerns around claim accuracy, misuse of automation, and insufficient technical evidence.

Key drivers include:

-

Rapid growth in AI-related R&D submissions

-

Increased use of automation to prepare claims

-

Concerns about inflated or routine activity being misclassified as R&D

-

Protection of public funds through stricter compliance enforcement

These factors have pushed HMRC to adopt more aggressive review mechanisms.

HMRC’s Use of AI and Transparency Challenges

One of the most significant hmrc ai r&d claims challenges emerged from HMRC’s own use of artificial intelligence during compliance checks.

The Elsbury Tribunal Ruling (2025)

A landmark First-tier Tribunal decision, Elsbury v The Information Commissioner (2025), raised serious transparency concerns about HMRC’s potential use of AI when reviewing R&D claims.

Key findings included:

-

Taxpayers noticed unusual HMRC correspondence

-

Letters contained American spellings, odd punctuation, and incoherent phrasing

-

These patterns strongly suggested AI-generated drafting

Initially, HMRC adopted a “neither confirm nor deny” stance, citing risks to tax collection. The Tribunal ruled that public interest in transparency outweighed those concerns, ordering disclosure.

Unauthorized AI Use Risks Within HMRC

Further hmrc ai r&d claims challenges surfaced when reports indicated that individual HMRC caseworkers may have used unauthorised AI tools.

Risks identified included:

-

Breaches of taxpayer confidentiality

-

Mishandling of sensitive commercial data

-

Lack of oversight or governance controls

Although HMRC later confirmed that its R&D compliance team did not use generative AI to draft taxpayer letters, the case highlighted systemic governance concerns.

Challenges in Making AI-Related R&D Claims

While AI development can qualify for R&D tax relief, hmrc ai r&d claims challenges arise when claims fail to meet strict eligibility criteria.

Routine vs Innovative AI Development

HMRC draws a clear distinction between:

-

Genuine technological advancement

-

Routine data processing or software configuration

Projects involving AI for standard automation, basic analytics, or off-the-shelf implementation are increasingly rejected.

Evidence Requirements for AI-Driven R&D

Another major hmrc ai r&d claims challenge is the level of documentation now expected.

HMRC requires:

-

Detailed explanations of technological uncertainty

-

Records of failed or abandoned approaches

-

Evidence of advancement beyond existing knowledge

Many AI projects struggle because this evidence was not documented contemporaneously.

Subcontracting Rules and Overseas AI Development

Changes to subcontracting rules have further intensified hmrc ai r&d claims challenges, particularly where AI development is outsourced.

Key complications include:

-

Overseas subcontractor eligibility restrictions

-

Ambiguity over who bears R&D risk

-

Contractual ownership of innovation

Incorrect interpretation can invalidate otherwise genuine claims.

Risks of Using AI to Prepare R&D Claims

Using AI tools to draft R&D submissions introduces another layer of hmrc ai r&d claims challenges.

AI Hallucinations

AI systems can generate inaccurate or fabricated technical narratives. When included in claims, these errors significantly increase rejection risk.

Generic Claim Narratives

HMRC increasingly rejects claims that contain:

-

Formulaic descriptions

-

Non-specific technical language

-

Recycled explanations lacking project detail

AI-generated content often fails to meet the required evidential threshold.

Legal and Contextual Limitations

AI tools cannot reliably interpret evolving legal definitions of R&D under UK tax law. This creates compliance gaps that human expertise must address.

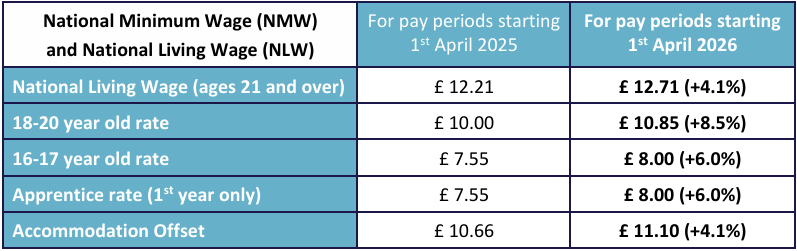

HMRC Enquiry Rates and Cash-Flow Impact

HMRC AI R&D claims challenges now directly affect business liquidity.

Current data shows:

-

17% of claims go into enquiry

-

Average delay of 246 days

-

Increased administrative burden

For SMEs, these delays can significantly disrupt operational planning.

How to Navigate HMRC AI R&D Claims Challenges Successfully

Despite increasing complexity, businesses can still secure legitimate relief by adopting best practices.

Submit Robust Technical Documentation

Claims should include:

-

Clear descriptions of technological uncertainty

-

Evidence of experimentation and iteration

-

Engineering or development logs

Use Experienced R&D Tax Professionals

Given the scale of hmrc ai r&d claims challenges, reliance on AI-only claim tools is strongly discouraged. Professional oversight significantly improves compliance outcomes.

Review and Challenge Inconsistent HMRC Correspondence

If HMRC letters appear generic, inconsistent, or automated, businesses may have grounds to challenge the quality of the review process.

HMRC’s Expert Advisory Panel and Future Oversight

HMRC has established an Expert Advisory Panel to address increasing complexity in AI and technology-driven R&D claims.

This panel aims to:

-

Improve consistency in claim assessments

-

Provide technical insight into emerging technologies

-

Reduce inappropriate rejections

However, scrutiny levels are expected to remain high.

What UK Businesses Should Do Now

HMRC AI R&D claims challenges are not temporary. They represent a structural shift in how innovation incentives are regulated.

Businesses should:

-

Strengthen internal R&D documentation processes

-

Review AI usage within claim preparation

-

Stay informed on tribunal outcomes and policy updates

At Business Western, we continue to monitor HMRC developments to help UK businesses adapt confidently and compliantly.

FAQs

What are HMRC AI R&D claims challenges?

HMRC AI R&D claims challenges refer to increased scrutiny of R&D tax relief claims involving artificial intelligence, including documentation standards, AI-generated content, and HMRC’s own use of AI.

Does AI development qualify for R&D tax relief?

Yes, but only where AI development involves genuine technological uncertainty and advancement beyond existing knowledge.

Can AI be used to prepare R&D claims?

Using AI alone is risky. AI-generated narratives often lack the technical specificity and legal accuracy required by HMRC.

Why are HMRC enquiries increasing?

HMRC is responding to rising claim volumes, misuse of automation, and concerns about claim quality and accuracy.

How long can HMRC enquiries delay payment?

Current data shows average delays of approximately 246 days for claims under enquiry.

Final Thoughts from Business Western

HMRC AI R&D claims challenges highlight a new era of accountability for UK innovation. Transparency, evidence, and professional oversight are no longer optional—they are essential.

At BusinessWestern.co.uk, we remain committed to delivering clear, authoritative insights that help UK businesses navigate regulatory change with confidence and clarity.