Business Asset Disposal Relief: Complete UK Guide for 2026

Business asset disposal relief is a UK tax relief that reduces Capital Gains Tax when selling qualifying business assets or shares. For UK entrepreneurs, it can significantly lower tax when exiting a business, making it one of the most valuable reliefs available today.

At Business Western, we focus on simplifying complex UK business and tax topics, and this guide explains business asset disposal relief clearly, accurately, and in full detail for 2026 and beyond.

What Is Business Asset Disposal Relief?

Business asset disposal relief (BADR), previously known as Entrepreneurs’ Relief, is a UK Capital Gains Tax relief that allows eligible individuals to pay a reduced CGT rate when disposing of qualifying business assets.

Instead of paying standard CGT rates, business asset disposal relief applies a lower tax rate to qualifying gains, subject to strict eligibility conditions and a lifetime limit.

This relief is designed to encourage entrepreneurship by rewarding business owners when they sell or close their businesses.

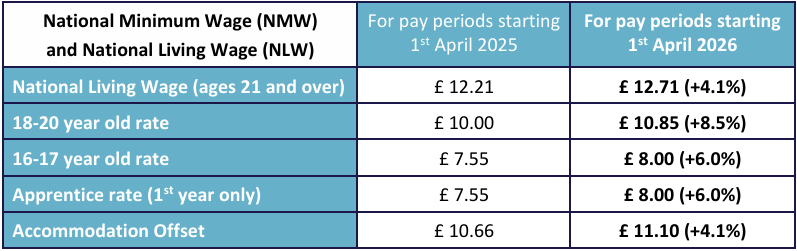

Business Asset Disposal Relief Rates (2024–2026)

Business asset disposal relief rates are changing, and timing matters.

Current and upcoming rates are:

-

Until 5 April 2025: 10% CGT on qualifying gains

-

From 6 April 2025 to 5 April 2026: 14% CGT

-

From 6 April 2026 onwards: 18% CGT

The rate you pay depends on the date of disposal, not when payment is received. Planning disposals carefully is essential to maximise business asset disposal relief benefits.

Lifetime Limit for Business Asset Disposal Relief

Business asset disposal relief has a £1 million lifetime limit.

This means:

-

The reduced CGT rate applies only to the first £1 million of qualifying gains

-

Once the limit is used, further gains are taxed at standard CGT rates

Previously, the lifetime allowance was £10 million, but it was reduced to £1 million and remains unchanged for 2026.

Who Can Claim Business Asset Disposal Relief?

Business asset disposal relief is available to:

-

Individual business owners

-

Sole traders

-

Partners in partnerships

-

Shareholders in personal companies

-

Trustees of qualifying settlements

Companies cannot claim business asset disposal relief directly; it applies only to individuals and certain trustees.

Qualifying Conditions for Business Asset Disposal Relief

To claim business asset disposal relief, strict conditions must be met.

Selling a Business (Sole Trader or Partnership)

You must:

-

Have owned all or part of the business for at least two years

-

Be disposing of the whole business or part of it

-

Be trading, not investing

Selling Shares in a Personal Company

For business asset disposal relief on shares, you must:

-

Own at least 5% of shares

-

Hold 5% of voting rights

-

Be entitled to 5% of profits and assets

-

Be an employee or officer of the company

-

Meet all conditions for at least two years before disposal

Associated Assets

Business asset disposal relief can also apply to associated assets, such as:

-

Property owned personally but used by the business

-

Assets sold alongside the business

These assets must have been used in the business and sold as part of the overall disposal.

Business Asset Disposal Relief After Business Closure

Business asset disposal relief may still be available even after closing a business.

You can claim if:

-

Assets are sold within three years of business closure

-

The qualifying ownership conditions were met before closure

This rule is particularly helpful for sole traders winding down operations.

What Assets Qualify for Business Asset Disposal Relief?

Qualifying assets include:

-

Entire businesses or parts of businesses

-

Shares in personal trading companies

-

Assets used in a business and sold with it

Non-trading assets and investment-only businesses generally do not qualify for business asset disposal relief.

How Business Asset Disposal Relief Works

Business asset disposal relief follows a simple process.

-

Identify the gain

Calculate the profit from selling the business or asset. -

Apply the relief

The gain is taxed at the reduced business asset disposal relief rate. -

Check the lifetime limit

Ensure gains fall within the £1 million allowance. -

Claim from HMRC

Relief is not automatic and must be claimed.

How to Claim Business Asset Disposal Relief

You must actively claim business asset disposal relief through HMRC.

Key points:

-

Claim via Self Assessment tax return

-

Deadline is the first anniversary of 31 January following the tax year of disposal

-

Late claims are usually rejected

Missing the deadline can result in paying full CGT instead of the reduced business asset disposal relief rate.

Business Asset Disposal Relief Example

Example:

A UK business owner sells their company shares in June 2025 and makes a £500,000 gain.

-

The gain qualifies for business asset disposal relief

-

CGT rate applied: 14%

-

Tax payable: £70,000

Without business asset disposal relief, CGT could exceed £120,000, showing how valuable the relief can be.

Why Business Asset Disposal Relief Matters

Business asset disposal relief offers major advantages:

-

Significantly lower CGT compared to standard rates

-

Rewards long-term business ownership

-

Encourages business growth and entrepreneurship

-

Improves exit planning for UK business owners

For higher-rate taxpayers, business asset disposal relief can save tens or even hundreds of thousands of pounds.

Common Mistakes to Avoid

Many claims fail due to avoidable errors.

Common mistakes include:

-

Failing the two-year ownership rule

-

Incorrect shareholding percentages

-

Missing HMRC deadlines

-

Assuming relief is automatic

-

Selling non-qualifying assets

Professional advice is strongly recommended before relying on business asset disposal relief.

Business Asset Disposal Relief vs Standard CGT

Business asset disposal relief applies a reduced rate compared to standard CGT.

Typical comparison:

-

Standard CGT: up to 24% or more

-

Business asset disposal relief: 10%–18% (depending on year)

This difference explains why correct planning around business asset disposal relief is essential.

Planning Ahead for Business Asset Disposal Relief in 2026

With CGT rates rising, forward planning is more important than ever.

Consider:

-

Timing disposals before rate increases

-

Reviewing share structures

-

Ensuring trading status remains valid

-

Keeping ownership records clear

Early planning can protect eligibility for business asset disposal relief.

FAQs About Business Asset Disposal Relief

What is business asset disposal relief?

Business asset disposal relief is a UK Capital Gains Tax relief that reduces tax on qualifying business disposals.

Is business asset disposal relief still 10%?

It is 10% until April 2025, 14% until April 2026, and 18% from April 2026.

What is the lifetime limit?

The lifetime limit for business asset disposal relief is £1 million of gains.

Do I need to claim business asset disposal relief?

Yes, you must actively claim business asset disposal relief through HMRC.

Can trustees claim business asset disposal relief?

Yes, trustees of qualifying settlements may claim in specific circumstances.

Final Thoughts from Business Western

Business asset disposal relief remains one of the most powerful tax reliefs available to UK entrepreneurs, even with rising CGT rates. Understanding the rules, conditions, and timing can make a significant financial difference when selling a business.

At Business Western, we aim to provide clear, reliable UK business insights that help owners make informed decisions. If you are planning a business exit, understanding business asset disposal relief should be a top priority in your strategy.