Family Investment Company UK: Complete 2026 Wealth Structuring Guide

Family Investment Company UK: Complete 2026 Wealth Structuring Guide

A family investment company is a private limited company set up to hold and manage family wealth in a tax-efficient and controlled way. In the UK, a family investment company is widely used as an alternative to trusts for inheritance tax planning, succession planning, and long-term asset protection.

At BusinessWestern.co.uk, we regularly analyse UK wealth structures, and the family investment company has become one of the most discussed strategies among high-net-worth families in 2026.

What Is a Family Investment Company?

A family investment company is a UK private limited company created to invest rather than trade. The purpose of a family investment company is to hold assets such as cash, property, equity portfolios, and other investments for the benefit of family members.

Unlike trading companies, a family investment company focuses purely on investment activities. Parents are typically directors and shareholders, while children or other family members may hold different share classes.

Key definition:

A family investment company is a flexible, tax-efficient corporate vehicle used for long-term wealth preservation and inheritance planning under UK rules.

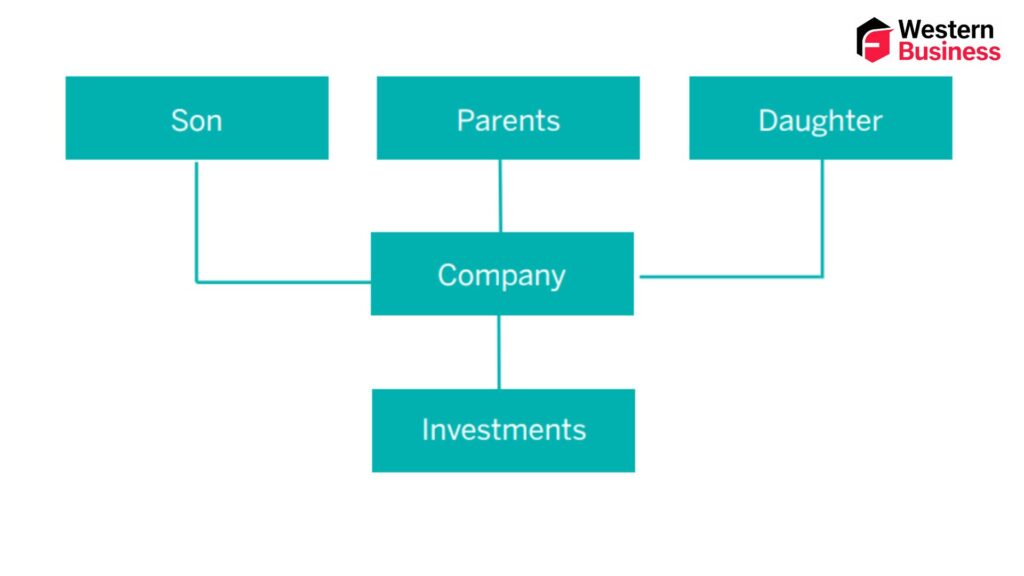

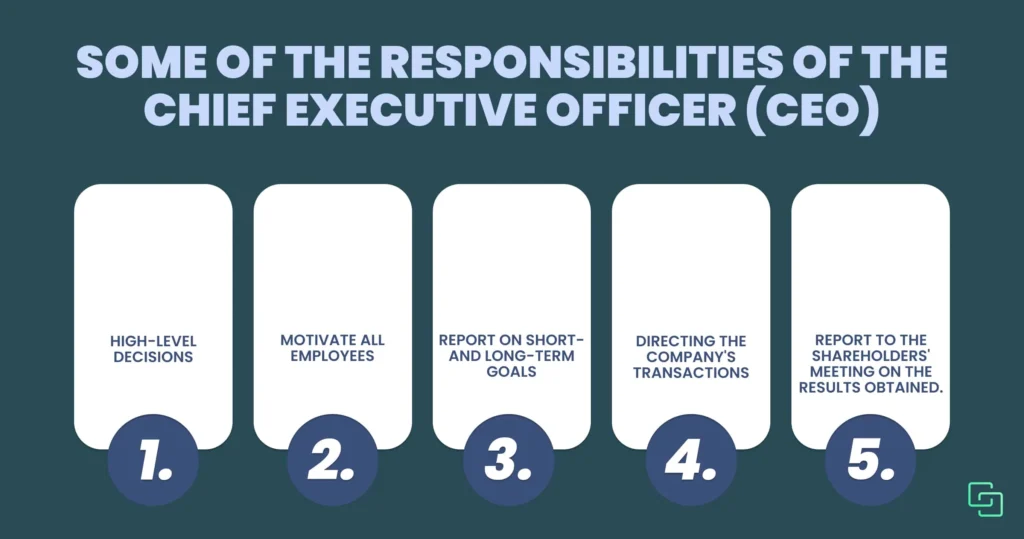

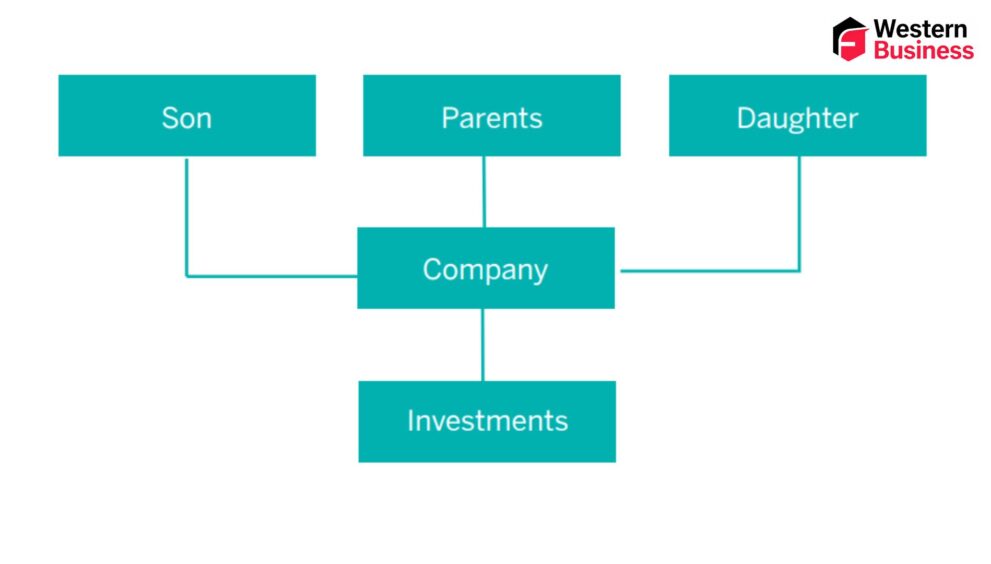

How a Family Investment Company Works

A family investment company operates like any other UK limited company but with a tailored share structure.

Typical structure includes:

-

Parents as directors controlling decisions

-

Different share classes (A shares, B shares, etc.)

-

Dividend rights allocated strategically

-

Shares gifted gradually to children

The family injects capital into the family investment company. That capital is then invested in:

-

Property portfolios

-

Stock market investments

-

Bonds

-

Funds

-

Other income-generating assets

Profits generated inside the family investment company are taxed at corporation tax rates rather than personal income tax rates.

Tax Efficiency of a Family Investment Company in 2026

One of the main reasons families use a family investment company is tax efficiency.

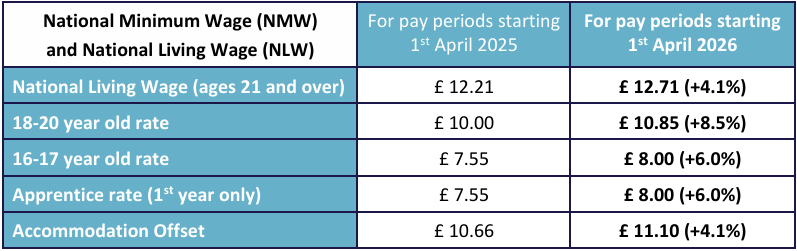

Corporation tax rates in 2026 range between 19% and 25%, depending on profits. This is often lower than higher-rate personal income tax.

Key tax benefits:

-

Profits taxed at corporation tax rates

-

Potential tax deferral on income and capital growth

-

Shares gifted may fall outside the estate for Inheritance Tax after seven years

-

Structured dividend distribution

However, there is a second layer of taxation when profits are extracted as dividends by shareholders.

This means a family investment company works best for long-term accumulation rather than short-term income extraction.

Key Features and Benefits of a Family Investment Company

Tax Efficiency

Profits within a family investment company are charged at corporate rates. This can reduce immediate tax compared to personal ownership.

Control and Flexibility

Parents usually remain directors of the family investment company, maintaining control over investments. Different share classes can control dividend rights without giving up control.

Succession Planning

Shares in a family investment company can be gifted to children. After seven years, they may fall outside the donor’s estate for Inheritance Tax purposes.

Asset Protection

A family investment company can offer protection against:

-

Divorce settlements

-

Creditor claims

-

Family disputes

Long-Term Wealth Preservation

A family investment company is particularly suited for preserving wealth across generations rather than distributing income quickly.

Costs of Setting Up a Family Investment Company

Setting up a family investment company involves professional fees.

Typical costs include:

-

Legal structuring fees

-

Tax advisory fees

-

Company formation costs

-

Annual accounting and compliance fees

Setup expenses can range from several thousand pounds depending on complexity. Ongoing annual compliance costs must also be considered.

A family investment company is generally used by high-net-worth individuals with significant cash assets available for long-term investment.

Pros and Cons of a Family Investment Company

Pros

-

Lower corporation tax on retained profits

-

Structured inheritance tax planning

-

Retained parental control

-

Flexible dividend planning

-

Strong long-term wealth vehicle

Cons

-

Setup and compliance costs

-

Double taxation when extracting profits

-

Complexity compared to personal ownership

-

Not ideal for short-term income needs

Before forming a family investment company, professional financial and legal advice is essential.

Family Investment Company vs Trust

Many UK families compare a family investment company with a trust.

Key differences:

Family Investment Company

-

Corporate structure

-

Corporation tax rates

-

Greater control through directorship

-

Transparent company reporting

Trust

-

Separate legal arrangement

-

Trust taxation rules

-

Managed by trustees

-

Often more rigid

A family investment company can provide more flexibility and direct control compared to traditional trusts.

Is a Family Investment Company a Good Idea?

A family investment company may be suitable if:

-

You have substantial capital

-

You want long-term inheritance planning

-

You want to retain control

-

You aim to mitigate Inheritance Tax exposure

-

You are comfortable with corporate compliance

It may not be ideal if:

-

You need regular personal income

-

Your investment capital is limited

-

You want simple personal ownership

Each family investment company should be tailored to specific financial goals.

Real-World Example

Consider a UK family with £2 million in investable cash.

Instead of investing personally at higher income tax rates, they establish a family investment company. The funds are invested in diversified equity portfolios and property.

Profits are retained within the family investment company and taxed at corporation tax rates. Over time, shares are gradually gifted to children.

After seven years, those gifted shares may fall outside the estate for Inheritance Tax purposes, making the family investment company a strategic long-term planning vehicle.

Who Typically Uses a Family Investment Company?

A family investment company is commonly used by:

-

High-net-worth families

-

Business owners after company sale

-

Property investors

-

Multi-generational wealth holders

It is not a trading company. It is purely an investment vehicle.

FAQs

What is a Family Investment Company (FIC)?

A Family Investment Company (FIC) is a private limited company in the UK created to hold and manage family wealth, including cash, property, and investments. Unlike trading companies, FICs are designed purely for investment purposes, allowing families to plan inheritance, retain control, and manage long-term wealth efficiently.

What is the main purpose of a Family Investment Company?

The main purpose of a FIC is to build and protect family wealth, manage succession planning, and provide long-term asset protection for children and future generations. It offers a structured, tax-efficient alternative to trusts.

How is a Family Investment Company structured?

A FIC is a private company limited by shares. Typically:

-

Parents or grandparents act as directors

-

Shares are issued in different classes (alphabet shares) to manage voting rights, dividend entitlements, and capital distributions

-

Beneficiaries, such as children, can hold shares with defined rights

How does a Family Investment Company work?

Founders fund the FIC using cash, loans, or gifts. The FIC invests in assets like property, stocks, bonds, and funds. Profits are taxed at corporation tax rates inside the company, and dividends can later be distributed to shareholders, often including family members. This allows founders to retain control while passing future growth to beneficiaries.

What are the tax advantages of a Family Investment Company?

-

Profits are taxed at UK corporation tax rates (19%–25% in 2026), often lower than higher-rate personal income tax.

-

Capital growth within the FIC is tax-efficient.

-

Shares gifted may fall outside the founder’s estate for Inheritance Tax after seven years.

-

Structured dividend policies allow flexible income distribution.

Can a Family Investment Company reduce Inheritance Tax (IHT)?

Yes. By placing assets within a FIC and gifting shares gradually, families can freeze the value of the founder’s estate. This allows future growth to occur outside the estate, reducing potential IHT liabilities for children and grandchildren.

Who controls a Family Investment Company?

Typically, parents or grandparents act as directors and maintain control over investment strategy and dividend policies. This control remains even if they own a minority of the shares, making FICs more flexible than traditional trusts.

What are the benefits of a Family Investment Company?

-

Control: Directors maintain investment strategy and decision-making power

-

Tax efficiency: Corporate taxation may be lower than personal income tax

-

Inheritance planning: Freezes estate value for IHT purposes

-

Flexibility: Share classes and articles can restrict share transfers

-

Asset protection: Safeguards against divorce, creditors, or disputes

What are the considerations or drawbacks of a Family Investment Company?

-

Setup costs are significant, typically suitable for families with £3–5 million in investable assets

-

Ongoing compliance with Companies House and HMRC is required

-

Dividend distribution may trigger a second layer of taxation

-

Best suited for long-term wealth accumulation rather than short-term income needs

How much does it cost to set up a Family Investment Company?

Setup costs include legal, tax, and advisory fees, which can run into several thousand pounds. Ongoing annual accounting, compliance, and filing costs with Companies House and HMRC are additional.

Who typically uses a Family Investment Company?

FICs are mostly used by:

-

High-net-worth families

-

Property investors

-

Business owners after a company sale

-

Multi-generational families seeking structured inheritance planning

Is a Family Investment Company better than a trust?

It depends on the family’s objectives:

-

FIC offers corporate tax treatment, direct control, and flexible dividend policies

-

Trusts follow separate taxation rules, are managed by trustees, and often have more rigid structures

-

FICs are generally preferred for families seeking control and long-term wealth growth

Can property be placed into a Family Investment Company?

Yes. Property is one of the common assets held in a FIC. The company can buy, manage, and invest in property, allowing profits to be taxed at corporation rates rather than personal rates.

Are profits in a Family Investment Company taxed twice?

Profits inside the FIC are taxed at corporation tax rates. If distributed as dividends to shareholders, a second layer of taxation applies at the dividend tax rate, which is a key consideration for planning.

Is a Family Investment Company suitable for small investors?

Generally, FICs are more suitable for individuals or families with significant investable assets due to the setup and ongoing compliance costs. Smaller estates may benefit more from trusts or outright gifting.

Can a Family Investment Company provide asset protection?

Yes. Through customized articles of association, a FIC can restrict share transfers, protecting assets from divorce settlements, creditors, or other disputes while maintaining family control.

How flexible is a Family Investment Company?

Very flexible. Families can structure share classes, dividend policies, voting rights, and transfer restrictions to meet specific long-term financial and inheritance objectives.

Final Thoughts on Family Investment Company UK Planning

A family investment company is one of the most powerful long-term wealth structuring tools available in the UK in 2026. When structured correctly, a family investment company can combine tax efficiency, succession planning, asset protection, and retained control under one corporate framework.

At BusinessWestern.co.uk, we focus on practical UK business and financial strategies that genuinely support long-term growth. The family investment company is not a one-size-fits-all solution, but for the right family, it can be a highly effective vehicle for protecting and transferring wealth across generations.

Before establishing a family investment company, always consult qualified UK tax and legal professionals to ensure the structure aligns with your financial goals and HMRC regulations.