Investment Corporation of Bangladesh: Role, Functions, History, and Investment Impact

The Investment Corporation of Bangladesh is a state-owned financial institution established to strengthen Bangladesh’s capital market and promote long-term investment. It plays a vital role in mobilising savings, managing portfolios, and supporting economic growth through structured financial services.

For readers of BusinessWestern.co.uk, understanding how institutions like the Investment Corporation of Bangladesh operate is essential when analysing emerging markets, regional investment systems, and South Asian financial development from a UK and global business perspective.

What Is the Investment Corporation of Bangladesh?

The Investment Corporation of Bangladesh is a statutory corporation of the Government of the People’s Republic of Bangladesh, founded on 1 October 1976 under the Investment Corporation of Bangladesh Ordinance, 1976. Its primary objective is to develop the country’s capital market by encouraging investment and broadening investor participation.

As a government-backed entity, the Investment Corporation of Bangladesh acts as an investment banker, portfolio manager, market maker, and financial intermediary, supporting both institutional and individual investors.

Background and Establishment History

The Investment Corporation of Bangladesh was established at a time when Bangladesh’s capital market was underdeveloped and lacked investor confidence. The government created the institution to provide stability, structure, and professional investment management.

Key historical milestones include:

-

1976: Establishment under Ordinance No. XL of 1976

-

1980: Launch of the first branch in Chittagong

-

1980: Introduction of the first mutual fund

-

1990s–2000s: Expansion of portfolio management and loan facilities

Today, the Investment Corporation of Bangladesh remains one of the most influential public-sector investors in the Bangladeshi stock market.

Core Functions of the Investment Corporation of Bangladesh

The Investment Corporation of Bangladesh performs several interconnected functions that support capital market development and investor protection.

Capital Market Development

One of the primary roles of the Investment Corporation of Bangladesh is to strengthen the capital market by:

-

Mobilising domestic savings

-

Encouraging long-term investment

-

Reducing excessive market volatility

-

Broadening the investor base

This role is especially important in emerging economies where retail investors require institutional confidence.

Investment Banking Services

The Investment Corporation of Bangladesh functions as an investment banker by:

-

Acting as a market maker

-

Managing diversified portfolios

-

Supporting equity financing

-

Assisting in structured investment products

These services help stabilise the market during periods of uncertainty.

Financial and Loan Services

The Investment Corporation of Bangladesh provides several financial facilities, including:

-

Term deposits

-

Margin loans

-

Term loans to finance equity gaps

-

Investment-backed lending

Such services enable investors to participate in the capital market with reduced liquidity pressure.

Role as a Nodal Development Financial Institution

The Investment Corporation of Bangladesh has been designated as the Nodal Development Financial Institution (DFI) for the South Asian Development Fund (SADF). This role positions the institution as a regional facilitator for development-oriented investments.

Through this responsibility, the Investment Corporation of Bangladesh supports cross-border financial cooperation and long-term economic projects across South Asia.

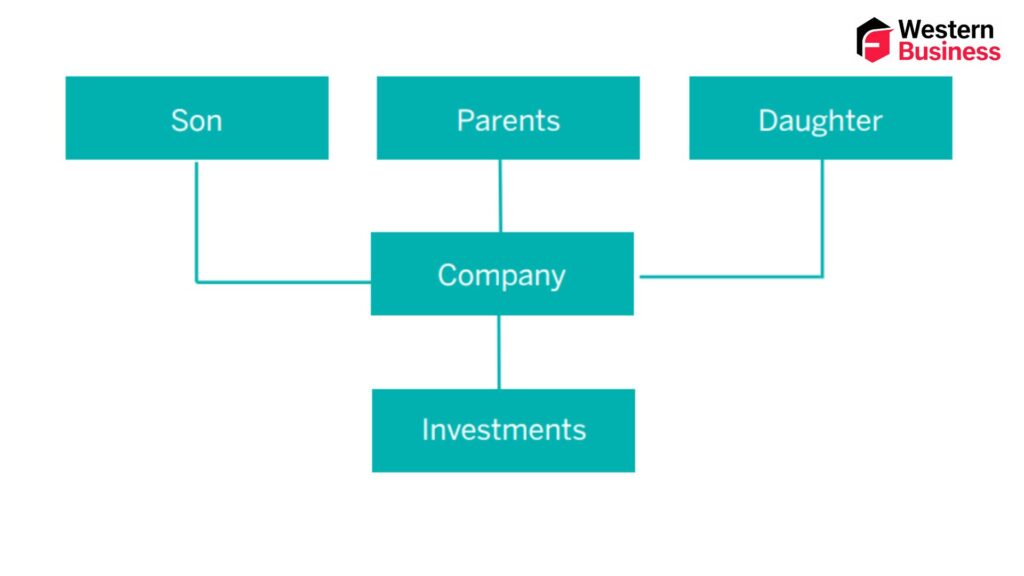

Subsidiaries of the Investment Corporation of Bangladesh

To expand its operational capacity, the Investment Corporation of Bangladesh operates through several specialised subsidiaries.

ICB Capital Management Limited

ICB Capital Management Limited focuses on:

-

Portfolio management services

-

Issue management

-

Corporate advisory services

It plays a crucial role in professional investment handling.

ICB Asset Management Company Limited

ICB Asset Management Company Limited manages:

-

Mutual funds

-

Unit funds

-

Institutional asset portfolios

This subsidiary helps retail investors access professionally managed funds.

ICB Securities Trading Company Limited

ICB Securities Trading Company Limited is responsible for:

-

Share trading activities

-

Market participation on stock exchanges

-

Supporting liquidity in equity markets

Together, these subsidiaries strengthen the overall effectiveness of the Investment Corporation of Bangladesh.

Online Services and Digital Investor Support

The Investment Corporation of Bangladesh provides digital services through its official platform, icb.org.bd. These online facilities include:

-

Tax certificates

-

Investor account services

-

Investment records

-

Recruitment and mobile applications

Digital accessibility has significantly improved transparency and investor confidence.

Importance of the Investment Corporation of Bangladesh for Investors

For individual and institutional investors, the Investment Corporation of Bangladesh offers several strategic advantages.

Key benefits include:

-

Government-backed credibility

-

Professional fund management

-

Reduced market risk exposure

-

Access to structured financial products

These features make the Investment Corporation of Bangladesh particularly attractive to long-term investors.

Economic Impact on Bangladesh’s Financial System

The Investment Corporation of Bangladesh is one of the largest institutional investors in the country’s stock market. Its investment decisions often influence overall market sentiment and stability.

By acting as a counterbalance during market downturns, the Investment Corporation of Bangladesh contributes to financial resilience and sustainable economic growth.

Relevance for UK and Global Investors

From a UK-based analytical perspective, institutions like the Investment Corporation of Bangladesh provide insight into how emerging markets manage capital development. For readers of BusinessWestern.co.uk, this offers valuable context when comparing financial systems, public-sector investment models, and regional economic strategies.

Understanding the Investment Corporation of Bangladesh helps global investors evaluate risk, governance, and growth potential in South Asian markets.

Frequently Asked Questions

What is the main function of the Investment Corporation of Bangladesh?

The main function of the Investment Corporation of Bangladesh is to develop the capital market by mobilising savings, promoting investment, and providing professional financial services.

When was the Investment Corporation of Bangladesh established?

The Investment Corporation of Bangladesh was established on 1 October 1976 under the Investment Corporation of Bangladesh Ordinance, 1976.

Is the Investment Corporation of Bangladesh government-owned?

Yes, the Investment Corporation of Bangladesh is a state-owned statutory corporation under the Government of Bangladesh.

What subsidiaries operate under the Investment Corporation of Bangladesh?

Major subsidiaries include ICB Capital Management Limited, ICB Asset Management Company Limited, and ICB Securities Trading Company Limited.

Does the Investment Corporation of Bangladesh offer online services?

Yes, the Investment Corporation of Bangladesh provides online investor services, tax certificates, and digital access through its official website.

Conclusion

The Investment Corporation of Bangladesh remains a cornerstone of Bangladesh’s financial and capital market system. Through its investment banking role, market stabilisation efforts, and subsidiary operations, it continues to shape investor confidence and economic growth.

For BusinessWestern.co.uk, analysing institutions like the Investment Corporation of Bangladesh aligns with our mission to provide UK and global readers with clear, authoritative insights into international business systems, emerging markets, and strategic investment frameworks that influence the global economy.