UK Supermarket Business Rates Impact: What the 2026 Reforms Mean for Retailers and Shoppers

The UK supermarket business rates impact is set to intensify from April 2026 as new government reforms increase costs for large retailers while offering relief to smaller businesses. These changes could affect food prices, store viability, investment decisions, and jobs across the UK supermarket sector.

At BusinessWestern.co.uk, we closely track UK business policy changes, and this guide explains the full UK supermarket business rates impact using official reform details, industry responses, and real-world implications.

What Is the UK Supermarket Business Rates Impact?

The UK supermarket business rates impact refers to the financial and operational pressure large supermarkets will face due to revised business rates from April 2026. Under the new system, supermarkets with large commercial properties will pay higher rates to fund relief for smaller retail, hospitality, and leisure businesses.

In simple terms, large supermarkets will shoulder more tax, while smaller high street shops receive targeted support.

Why Business Rates Are Changing in 2026

The UK government is reforming business rates to rebalance the retail tax burden and support struggling high streets.

Key reasons behind the reform

-

Support small businesses with lower rateable values

-

Reduce empty high street properties

-

Shift more tax responsibility to large commercial premises

-

Update outdated property valuations

These reforms directly shape the UK supermarket business rates impact for national chains.

How Much Will UK Supermarkets Pay?

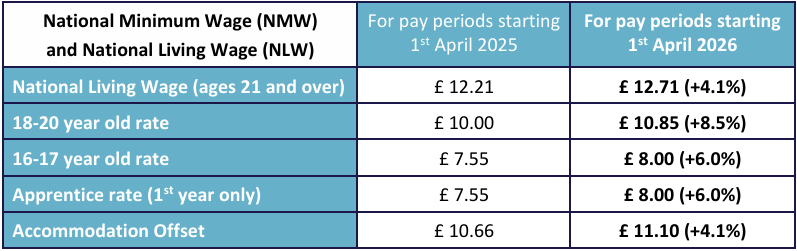

Large supermarkets are expected to see an average business rates increase of around 4% from April 2026.

What drives the increase

-

Introduction of a surtax on large properties

-

New banded multiplier system

-

Business rates revaluation based on 2021 rental values

This combination significantly amplifies the UK supermarket business rates impact, especially for stores with rateable values above £500,000.

Increased Operating Costs for Supermarkets

The most immediate UK supermarket business rates impact is higher operating costs.

Supermarkets are already facing pressure from:

-

Rising wages

-

Energy costs

-

Supply chain inflation

-

Compliance and logistics expenses

An additional tax burden tightens margins further, particularly for large-format stores.

Will Food Prices Rise for Shoppers?

Yes, higher food prices are a likely consequence of the UK supermarket business rates impact.

Major supermarket chains argue that increased business rates will be passed on to consumers through:

-

Higher shelf prices

-

Reduced promotional discounts

-

Smaller product ranges

Industry leaders warn this could worsen food inflation at a time when household budgets are already under strain.

Risk of Store Closures and Job Losses

One of the most serious consequences of the UK supermarket business rates impact is the risk of store closures.

What retailers are warning

-

Over 100 large supermarkets could become unprofitable

-

Marginal stores may close permanently

-

Job losses could follow store shutdowns

-

Communities may lose essential local services

Large stores with high overheads are most exposed under the new system.

Investment Could Slow Across the Sector

The UK supermarket business rates impact may also discourage long-term investment.

Higher and less predictable tax costs can lead to:

-

Fewer new store openings

-

Reduced refurbishment budgets

-

Slower job creation

-

Delayed technology upgrades

Retailers prefer stable tax environments when planning multi-year investments.

How the New Banded Multiplier System Works

A major driver of the UK supermarket business rates impact is the new banded multiplier system.

How it applies

-

Properties under £500,000 rateable value receive lower rates

-

Properties over £500,000 face higher multipliers

-

Large supermarkets fall into the highest band

This structure shifts tax responsibility from small independents to large national chains.

Business Rates Revaluation Explained

Another contributor to the UK supermarket business rates impact is the 2026 revaluation.

What revaluation means

-

Rateable values recalculated using 2021 rental data

-

Some supermarkets face sharp increases

-

Combined with higher multipliers, bills rise further

Even stores with flat sales could see higher tax bills due to valuation changes alone.

How Major Supermarkets Are Responding

Supermarkets have been vocal about the UK supermarket business rates impact.

Industry response includes

-

Lobbying for exemption from the surtax

-

Public warnings about price increases

-

Engagement with HM Treasury

-

Calls for broader retail tax reform

The British Retail Consortium argues that the policy risks harming growth rather than supporting it.

Does This Reform Really Help Small Businesses?

The intention behind the UK supermarket business rates impact is to help smaller businesses.

Potential benefits for small retailers

-

Lower rates for shops under £500,000 value

-

Greater viability for independent high street stores

-

Reduced pressure on hospitality and leisure venues

However, critics argue the policy simply shifts pressure rather than reducing it overall.

Wider Economic Implications

The UK supermarket business rates impact extends beyond supermarkets.

It could influence:

-

Employment levels

-

Consumer confidence

-

Inflation trends

-

Local supply chains

Large supermarkets play a key role in regional economies, so their financial health matters nationally.

Practical Takeaways for Retailers

Supermarket operators and investors should prepare early for the UK supermarket business rates impact.

Practical steps

-

Review rateable values with the VOA

-

Model post-2026 tax liabilities

-

Assess store profitability by location

-

Factor business rates into pricing strategies

Early planning can soften the financial shock.

FAQs

What is the UK supermarket business rates impact?

The UK supermarket business rates impact refers to higher business rates for large supermarkets from April 2026 due to new tax bands, surtaxes, and revaluation.

When do the new business rates start?

The reforms take effect from April 2026 across England.

Why are supermarkets being charged more?

Higher rates on large properties fund relief for smaller retail, hospitality, and leisure businesses.

Will supermarket prices increase?

Retailers warn higher business rates may lead to increased food prices for consumers.

Could supermarkets close stores?

Yes, industry estimates suggest over 100 large supermarkets could become unprofitable.

Conclusion: What This Means Going Forward

The UK supermarket business rates impact marks one of the most significant retail tax changes in recent years. While designed to support small businesses and revive high streets, it places substantial pressure on large supermarkets, with potential knock-on effects for prices, jobs, and investment.

At BusinessWestern.co.uk, we continue to analyse UK business policy changes so retailers, investors, and consumers can make informed decisions. As 2026 approaches, understanding the UK supermarket business rates impact will be essential for navigating the future of UK retail.