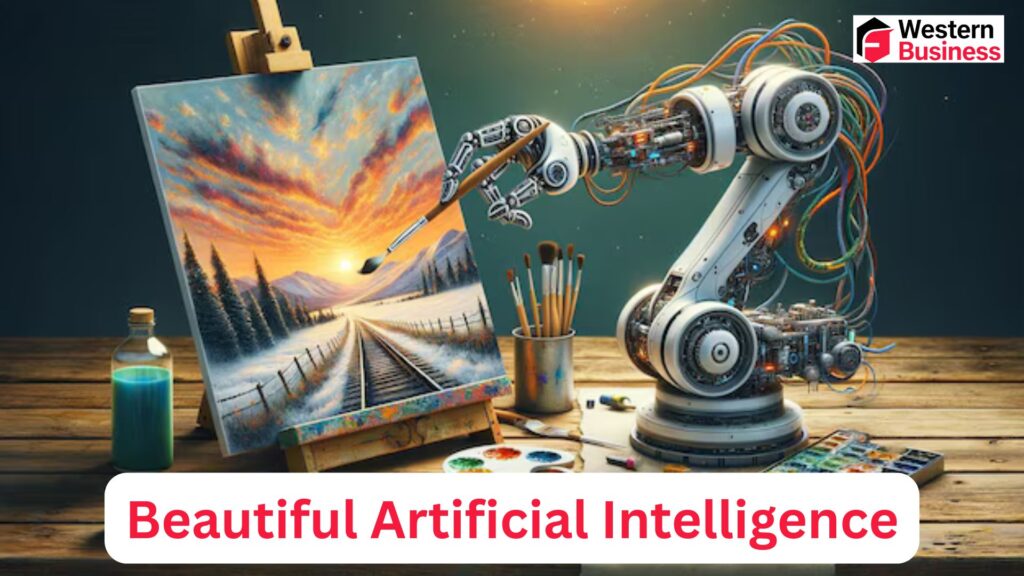

Hmrc R&D Tax Claim Transparency Ai: What the 2025 Tribunal Ruling Means for UK Businesses

Hmrc R&D Tax Claim Transparency Ai is now under legal pressure to disclose how artificial intelligence (AI) is used in R&D tax claim assessments following a landmark 2025 tribunal ruling.

This decision marks a major shift toward transparency, fairness, and accountability in how UK businesses’ R&D tax relief claims are reviewed—especially where automated systems may influence outcomes.

At Business Western, we closely follow UK regulatory and business developments that directly affect innovation-driven companies. This ruling is one of the most significant updates in the future of automated tax administration.

What Is Hmrc R&D Tax Claim Transparency Ai in the Context of AI?

HMRC R&D tax claim transparency refers to the obligation on HM Revenue & Customs to clearly disclose whether, how, and to what extent AI systems are used when assessing Research & Development (R&D) tax relief claims.

In 2025, this issue became critical after businesses began questioning whether automated or AI-assisted processes were influencing claim rejections without clear explanation.

Why HMRC’s Use of AI in R&D Tax Claims Came Under Scrutiny

The pressure on HMRC increased when taxpayers noticed unusual patterns in R&D claim rejection letters, including:

-

Generic or formulaic wording

-

American spellings inconsistent with UK standards

-

Repetitive phrasing across unrelated cases

These indicators raised concerns that AI-generated or AI-assisted systems might be involved in decision-making without adequate transparency.

The Landmark Tribunal Ruling: Elsbury v The Information Commissioner (2025)

What Did the Tribunal Decide?

In Elsbury v The Information Commissioner, a First-tier Tribunal ordered HMRC to disclose whether it uses artificial intelligence in R&D tax credit enquiries.

This ruling overturned HMRC’s earlier refusal to confirm or deny AI usage under Freedom of Information (FOI) rules.

Why Was the Ruling Significant?

The tribunal determined that:

-

The public interest in transparency outweighed HMRC’s concerns about aiding fraud

-

Consistent and fair treatment of taxpayers requires openness

-

AI involvement in complex tax decisions must be disclosed

This decision sends a clear message: automated decision-making in tax administration cannot remain opaque.

HMRC’s Initial Position and Legal Pressure

Initially, HMRC claimed it could “neither confirm nor deny” whether AI tools were being used to assess R&D claims.

However, following the ruling:

-

HMRC was compelled to disclose relevant information

-

Failure to comply could lead to contempt proceedings

-

The case set a precedent for future AI transparency challenges

Key Developments and Implications for UK Businesses

1. Increased Transparency Expectations

The ruling signals a shift toward greater openness in how HMRC evaluates R&D claims, particularly where AI may assist in risk assessment or decision-making.

2. Legal Grounds for Challenging Decisions

Claimants now have stronger legal grounds to question:

-

Whether AI influenced their claim outcome

-

Whether automated tools were applied fairly

-

Whether genuine innovation was wrongly rejected

3. Impact on Claimant Confidence

Transparency is essential for maintaining trust. The tribunal recognised that uncertainty around AI use undermines taxpayer confidence, particularly for SMEs relying on R&D relief to fund innovation.

4. Risk of Unfair Rejections

The ruling also highlights concerns that automated scrutiny may have already resulted in:

-

Legitimate claims being rejected

-

Inconsistent application of R&D criteria

-

Over-reliance on pattern detection rather than context

What This Means for R&D Tax Relief Going Forward

Enhanced Scrutiny of R&D Claims

HMRC has increased its focus on R&D compliance, including:

-

Mandatory submission of structured data via the Additional Information Form

-

Improved risk-assessment processes

-

Potential use of AI tools to flag anomalies

While these steps aim to reduce abuse, they also raise questions about accuracy and fairness.

Transparency Demands from Businesses

UK businesses can now reasonably expect:

-

Clear explanations of claim decisions

-

Disclosure where AI tools are involved

-

Justification for rejections beyond generic responses

Ethical Use of AI in Tax Administration

The ruling pushes HMRC toward ethical AI implementation, including:

-

Avoiding algorithmic bias

-

Ensuring accuracy in complex R&D rules

-

Maintaining human oversight in decision-making

These principles are critical when assessing innovation-driven activities that do not always fit rigid templates.

The Future of AI in UK Tax Systems

This case represents a landmark moment for public sector AI governance.

Why This Sets a Precedent

-

Public bodies must be transparent about AI in sensitive areas

-

Automated decision-making must be explainable

-

Accountability cannot be avoided through technology

The implications extend beyond R&D tax relief to future digital tax enforcement systems.

Real-World Example: What Businesses Should Do Now

If your business has:

-

Received a generic R&D rejection letter

-

Noticed inconsistent reasoning in HMRC correspondence

-

Faced repeated compliance checks without clarity

You should consider:

-

Requesting clarification on how your claim was assessed

-

Asking whether AI tools were involved

-

Seeking professional tax or legal advice

Practical Tips for Businesses Claiming R&D Tax Relief

-

Ensure technical narratives are clear, detailed, and evidence-based

-

Avoid generic descriptions of innovation

-

Align financial data with technical activities

-

Keep documentation consistent across submissions

Transparency works both ways—strong claims are harder to reject unfairly.

FAQs: HMRC, AI, and R&D Tax Claims

Is HMRC using AI to assess R&D tax claims?

Following a 2025 tribunal ruling, HMRC has been ordered to disclose whether and how AI is used in R&D tax relief assessments.

Why did taxpayers suspect AI involvement?

Suspicion arose due to generic language, American spellings, and unusual patterns in rejection letters.

Does this ruling help R&D claimants?

Yes. It provides legal grounds to demand transparency and challenge potentially automated or unfair decisions.

Can AI lead to incorrect R&D claim rejections?

Yes. Without proper oversight, AI tools risk misinterpreting complex innovation activities.

What should businesses do if their claim is rejected?

Seek clarification, request disclosure on AI involvement, and consult a qualified tax specialist.

Conclusion: Transparency Is the Future of Fair Taxation

The Hmrc R&D Tax Claim Transparency Ai tribunal ruling on AI transparency in R&D tax claims is more than a legal technicality—it is a turning point for trust, fairness, and accountability in UK tax administration.

For innovation-led businesses, understanding how decisions are made is essential. At BusinessWestern.co.uk, our mission is to keep UK entrepreneurs, founders, and decision-makers informed about regulatory changes that shape the business landscape.

As AI becomes more embedded in public systems, transparency will no longer be optional—it will be essential.