Luxembourg Business Register (LBR): Complete 2026 Guide to Company Registration & Search

The Luxembourg Business Register (LBR) is the official national system for registering, managing, and accessing company information in Luxembourg. As of 2026, it plays a central role in corporate transparency, legal compliance, and EU-wide business verification—making it a critical resource for entrepreneurs, investors, and compliance teams across Europe, including the UK.

At BusinessWestern.co.uk, we regularly cover European business systems that matter to UK professionals, and Luxembourg’s register stands out for its digital-first approach and regulatory clarity.

What Is the Luxembourg Business Register (LBR)?

The Luxembourg Business Register (LBR) is the official public authority responsible for managing and publishing information about legal entities operating in Luxembourg.

As of 2026, the LBR operates under the authority of the Luxembourg Minister of Justice and ensures corporate transparency in line with EU regulations.

Definition

The Luxembourg Business Register is the national body that maintains official company records, beneficial ownership data, and mandatory legal publications for all registered entities in Luxembourg.

Key Components of the Luxembourg Business Register

The LBR is not a single database. It operates through three core platforms, each serving a specific legal function.

1. Trade and Companies Register (RCS)

The Registre de Commerce et des Sociétés (RCS) is Luxembourg’s central commercial register.

It contains data on:

-

Commercial companies

-

Sole traders

-

Non-profit organisations (ASBLs)

-

Investment funds and partnerships

Stored information includes:

-

Company name and registration number

-

Legal form and registered office

-

Articles of association

-

Annual accounts

2. Register of Beneficial Owners (RBE)

The Registre des Bénéficiaires Effectifs (RBE) records the natural persons who ultimately own or control an entity.

This register supports:

-

Anti-money laundering (AML) compliance

-

EU transparency directives

-

Financial crime prevention

Requirement:

All Luxembourg entities must declare their beneficial owners within one month of incorporation.

3. RESA – Official Legal Publication Platform

RESA (Recueil électronique des sociétés et associations) is the official digital gazette for Luxembourg companies.

It publishes mandatory legal notices such as:

-

Director appointments or resignations

-

Mergers and restructurings

-

Company liquidations

Luxembourg Business Register Search (2026 Access Rules)

Public Search Availability

Most company data is freely searchable via the official LBR portal.

You can search by:

-

Company name

-

Registration number

Available documents include:

-

Articles of association

-

Registered office details

-

Filed annual accounts

This open-access approach makes Luxembourg one of the most transparent jurisdictions in the EU.

Mandatory Identification (LNIN Requirement)

Since late 2024, all individuals registered with the RCS—such as directors, managers, and partners—must hold a Luxembourg National Identification Number (LNIN).

If an individual does not already have one:

-

The LNIN is automatically issued during registration

Fully Digital Filing System

As of 2026:

-

All filings are 100% electronic

-

HTML-based forms have replaced older PDF submissions

-

This improves data accuracy and processing speed

Pillar 2 Tax Registration (New 2026 Requirement)

From 6 January 2026, Luxembourg introduced a mandatory Pillar 2 registration tool.

Who Must Register?

Entities falling under the OECD global minimum tax (Pillar 2) rules.

Key Deadline

-

Filing deadline: 30 June 2026

This reform directly impacts multinational groups with Luxembourg entities, including many UK-based structures.

How to Register a New Business in Luxembourg (Full 2026 Process)

Registering a business in Luxembourg involves a structured, multi-stage process managed through the LBR and the Ministry of the Economy.

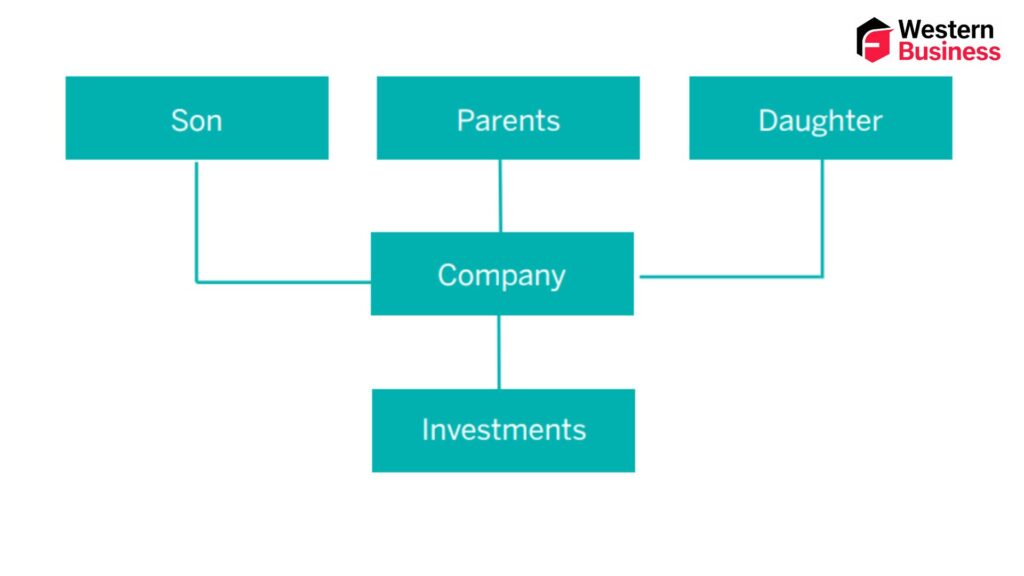

Step 1: Planning and Legal Structure Selection

Choose an appropriate legal form:

-

S.à r.l. (SARL) – Private Limited Company

-

Minimum capital: €12,000

-

-

S.A. – Public Limited Company

-

Minimum capital: €30,000

-

These are the most common structures for international founders.

Step 2: Name Availability Check

Before incorporation:

-

Verify your company name via the LBR search portal

-

Request a certificate of availability

This ensures no conflict with existing entities.

Step 3: Pre-Incorporation Formalities

Key requirements include:

-

Draft Articles of Association

-

Must define company purpose, governance, and registered office

-

Drafted in French or German (English requires translation)

-

-

Identify Natural Persons

-

All individuals must have an LNIN

-

-

Capital Deposit

-

Open a Luxembourg business bank account

-

Deposit minimum share capital

-

Obtain a blocking certificate from the bank

-

Step 4: Official Incorporation & RCS Filing

For SARL and SA companies:

-

Articles must be signed before a Luxembourg notary

-

The notary files the incorporation deed with the RCS within one month

Sole traders can file directly via MyGuichet.lu.

Step 5: Business Permit (Autorisation d’établissement)

Most activities require an establishment authorisation from the Ministry of the Economy.

Requirements include:

-

Professional integrity

-

A fixed physical location in Luxembourg

Cost: €50 stamp duty

Step 6: Post-Registration Obligations

After incorporation, you must:

-

Register beneficial owners in the RBE (within one month)

-

Register for corporate tax and VAT

-

Inland Revenue (ACD)

-

VAT Authority (AED)

-

-

Affiliate with CCSS (Social Security)

-

Within 8 days of starting operations

-

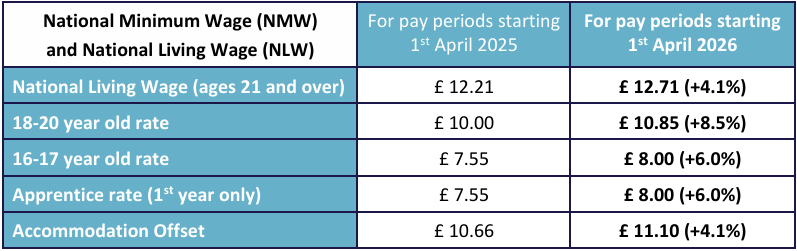

Registration Timeline and Costs (2026)

Typical Timeframe

-

2 to 4 weeks, depending on complexity and document readiness

Key Costs

-

Notary fees: €1,800+

-

RCS registration: ~€150

-

Minimum share capital (depends on legal form)

Why the Luxembourg Business Register Matters for UK Businesses

For UK entrepreneurs and investors, Luxembourg offers:

-

Strong EU market access

-

High transparency standards

-

Efficient digital registration

-

Trusted corporate data via LBR

At BusinessWestern.co.uk, we track European regulatory systems like the LBR because they directly affect cross-border structuring, compliance, and investment decisions for UK-based professionals.

FAQs: Luxembourg Business Register (LBR)

What is the Luxembourg Business Register?

The Luxembourg Business Register is the official national authority that manages company registration, beneficial ownership data, and legal publications for entities in Luxembourg.

Is the Luxembourg Business Register public?

Yes. Most company information, including articles of association and annual accounts, is publicly accessible for free.

What is the RCS in Luxembourg?

The RCS (Trade and Companies Register) is the main commercial database within the LBR, containing registration details for all legal entities.

What is the RBE?

The RBE records the natural persons who ultimately own or control Luxembourg entities, supporting AML and transparency regulations.

How long does it take to register a business in Luxembourg?

Typically between 2 and 4 weeks, depending on the legal structure and documentation.

Conclusion: Luxembourg Business Register in a European Business Context

The Luxembourg Business Register remains one of Europe’s most advanced and transparent corporate systems in 2026. Its fully digital filing, public search access, and strict compliance standards make it a preferred jurisdiction for international businesses.

For UK readers of BusinessWestern.co.uk, understanding systems like the LBR is essential when expanding into the EU, structuring investments, or conducting due diligence. As European regulations evolve, Luxembourg continues to set a benchmark for corporate transparency and efficiency.